Ideas on How to Teach This Topic:

Teaching Overview:

Taxes are used by the government mainly to raise money to pay for things like roads, lighting, trash collection, pay government employees such as police, fire, armed forces, post office, and fund welfare and other social programs.

- Introduce the glossary of terms that will be used so that students can tick them off as they are covered.

- Explain the different categories of taxes: Income, payroll, Property, and Consumption.

- Who needs to file a tax return?

- Complete activities:

i. Learn by doing and take a look at a tax return.

ii. Play Budgeting Game and complete Tax Simulation.

iii. Complete questions at the end.

Step 1: Introduce Your Students to the Basic Definitions

Before getting into any complex concepts, it’s always good for your students to be aware of the definitions, so that when they are covered in class, they can write them up or cross them off. Here are some examples.

- IRS: The Internal Revenue Service (IRS) is a bureau of the Department of Treasury that enforces income tax laws and oversees the collection of federal income taxes.

- Deductible: Able to be deducted; especially from taxable income or tax to be paid.

- Gross Income: Your income before it’s taxed.

- Net Income: The gross income minus taxes and other deductions.

- W2 Form: Document all hourly and salaried employees will receive from their employer at the end of the year

- Form 1099: Form used when a person needs to self-report income. This includes independent contractors, and anyone receiving income from a source that did not provide a W-2.

- Audits: An IRS official inspection of an individual’s or organization’s taxes.

- Sales tax: Extra tax that you will pay on certain goods and services -taxed on the price of the product bought. (varies from state to state).

Step 2: Teach Your Students About the Different Types of Taxes

Depending on the state you are in, the tax laws and rates will differ. However, there are generally four types of taxes: Income taxes, payroll taxes, property taxes, and consumption taxes. It is very highly recommended to research the tax rates of your state and share the exact rates with your students. Here are some basic definitions of the four types of taxes.

- Income Taxes: Tax enforced by a government directly on income.

- Payroll Taxes: Taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their staff.

- Property Taxes: Tax paid on property owned by an individual or a corporation.

- Consumption Taxes: A tax attached to the purchase of goods and services.

Step 3: Create Interactive Lesson Plans

Now that you’re students are aware of the basic term and types of taxes. here are some suggestions: There are also many other free lesson plan resources about taxes available here.

Lesson Plan: Income Tax

1. 1. What is Income Tax?

Income tax is the tax you pay on your income, usually directly taken out of your paycheck. Everyone who works in the United States should be paying income tax on their earnings.

Income is more than just wages and salaries too. If you earn rent from rental properties, investment income, interest on your savings account or bonds, or any other revenue stream, you will probably owe some income tax on it.

1. 2. How are Income Taxes Paid?

For most people, income taxes are straightforward – employers are required to withhold the appropriate income tax amount from your paycheck, which is then paid to the government without any extra steps.

If you are self-employed or work as an independent contractor (like a driver for Uber), it can be a bit more complicated. In this case, you are required to report your income and pay any taxes owed at the same time.

2.1. Who Needs to File an Income Tax Return?

All US citizens and everyone working and living in the United States needs to file an income tax return each year. By extension, all citizens and workers in the US need to report their income, even if that income is earned in another country. US citizens use their Social Security Number to file their taxes.

Even US residents who do not work need to file income taxes if they received some sort of income or compensation over the previous year. This includes things like rental earnings and even unemployment benefits.

2.2. Immigrant Workers

Workers who work in the United States without a Social Security Number (both legal immigrants and undocumented workers) are still required to pay income taxes. Since some of these workers may not have Social Security

Numbers, they can request an Individual Tax Identification Number (ITIN) from the IRS to use to file their taxes.

ITIN numbers can only be used for tax reporting purposes, and undocumented workers can avoid breaking income tax evasion laws by obtaining a ITIN number and filing their income tax returns.

2.3. US Citizens Living Abroad

US Citizens who live and work in other countries are also required to file their US income taxes each year or risk heavy fines. While citizens do need to file their taxes, most citizens living and working outside the US are exempt from actually owing any tax, unless they have exceptionally high incomes.

To View the full lesson plan for FREE CLICK HERE.

Step 4: Activities and Questions

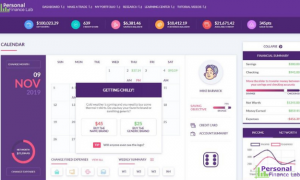

1. Budget Game Simulation

One of the greatest resources that can be used in the classroom, is a personal budgeting game simulator. In this simulation, your students take on the role of a college student with a part-time job with variable income, and both fixed and variable expenses. Teachers can set the fixed expenses, hourly wage, and income tax rates for your class. Students are then tasked with navigating real-life situations, which includes paying taxes. Learn More.

2. Taxation Simulation

Another really engaging and fun resource you can introduce into your classroom is the IRS taxation simulation. The IRS has over a dozen taxation simulations, which consists of different simulated taxpaying cases, and the students need to navigate and fill out questions regarding each simulated case.

3. Tax Forms:

Print out real federal income tax forms. The real IRS forms are available here.

Dues to its complexity and realistic chances of a student being able to fill in these forms, it would be worth showing your students the forms and summarizing the information required to fill them in. This also relates to the value of keeping important information up to date and accessible.

Questions:

- List the 4 different types of tax.

- Why are taxes collected?

- Which of these taxes apply to you on a day to day basis?

- Choose 5 states in the US (1 must be the one you live in) and, research the sales tax, property tax, income tax and gasoline tax levels.

- Using research, give ten examples (with figures if possible) of projects that the government has spent tax money on.

- In your opinion, should everyone be taxed the same percentage on their earnings or should different earning groups pay different percentages?