One of the most powerful ways we can make financial literacy stick is through hands-on experience. Students need a way to get practice in a safe environment where they can make mistakes and learn from them, before using real money. Stock market simulations turn theory into action, and with the right learning environment, confusion into confidence.

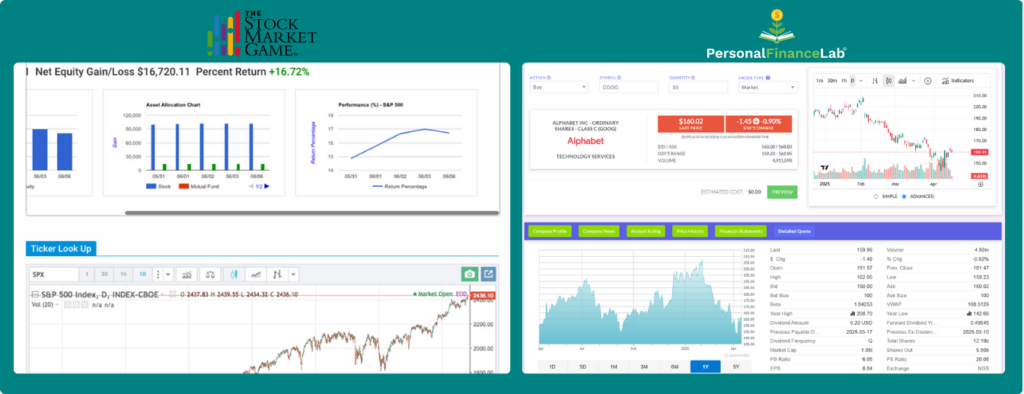

Now, when you’re looking for a stock simulation for your classroom, two big names likely come up: the SIFMA Foundation’s well-known Stock Market Game™ (SMG) and the feature-rich Stock Game from PersonalFinanceLab® (PFL). Both aim to get students learning how to invest their money with virtual stocks, bonds and mutual funds.

But here’s the thing: how they do it, the actual mechanics and features available to students and teachers, differs significantly. If you’re trying to decide which platform offers the most robust, engaging, and hassle-free stock simulation experience, you need to look under the hood.

Let’s put them head-to-head, focusing purely on the nuts and bolts of their stock games.

The Student Experience – Trading, Data, and Tools

The effectiveness of any simulation hinges on the quality of the student experience. This is where theoretical knowledge translates into practical application, directly impacting whether students achieve required financial literacy competencies. The platform must empower students to move beyond definitions and actively apply concepts.

It needs to provide an environment where they can effectively evaluate investment alternatives, understand the relationship between risk and return, learn to analyze market data, and experience the direct outcomes of their financial decisions.

How does each platform measure up when it comes to providing a valuable learning experience to students?

- How intuitive is the interface for students navigating complex financial information?

- How realistically does the simulation mirror actual market mechanics?

- And most importantly, how engaging is the day-to-day interaction?

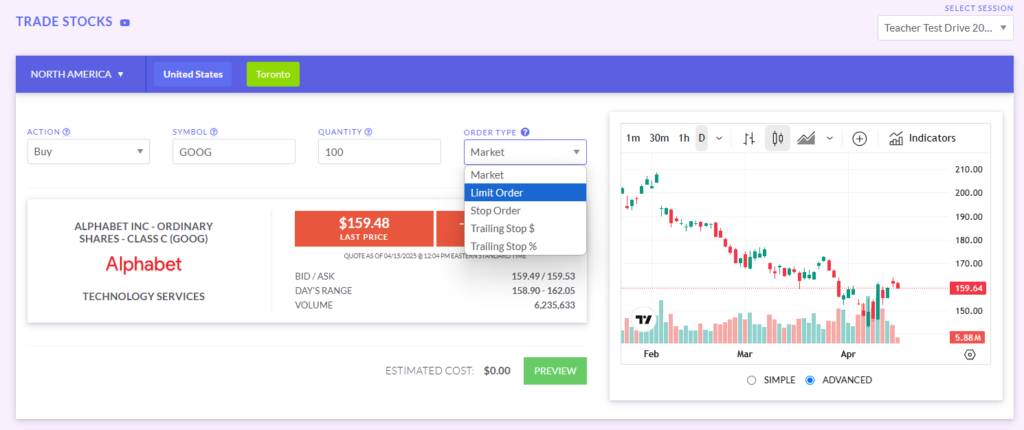

Placing Trades & Order Types:

- SMG: A common point of frustration is how orders are handled outside market hours. If a student places a market order when the market is closed, that order will simply be cancelled by the next morning, forcing them to re-enter it. This can be confusing and doesn’t reflect how orders work in the real world.

- PFL: Offers more sophisticated and realistic order options. Students can place market orders that will remain pending until the next market open (even days later). They can also use limit orders (buy/sell at a specific price or better), stop orders (trigger a market order if a certain price is reached), and even trailing stops (% or $ based) – tools that real investors use to manage risk and execute different investing strategies. This allows for more nuanced learning about investing tactics and mechanics.

Data Integrity (Splits & Dividends):

- SMG: When a company issues a stock split or pays out a dividend, these events aren’t automatically reflected in student portfolios. This means the student’s (or teacher’s) portfolio value will be inaccurate until they contact the SMG support team to manually adjust the holdings. These extra administrative steps are frustrating (to say the least).

- PFL: Handles stock splits and dividend payments automatically. The system adjusts share counts and cash balances as these events occur in the real market, maintaining portfolio accuracy without requiring manual intervention. It’s one less thing for you and your students to worry about!

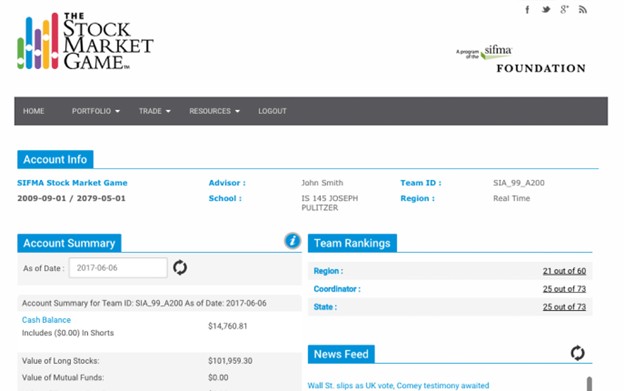

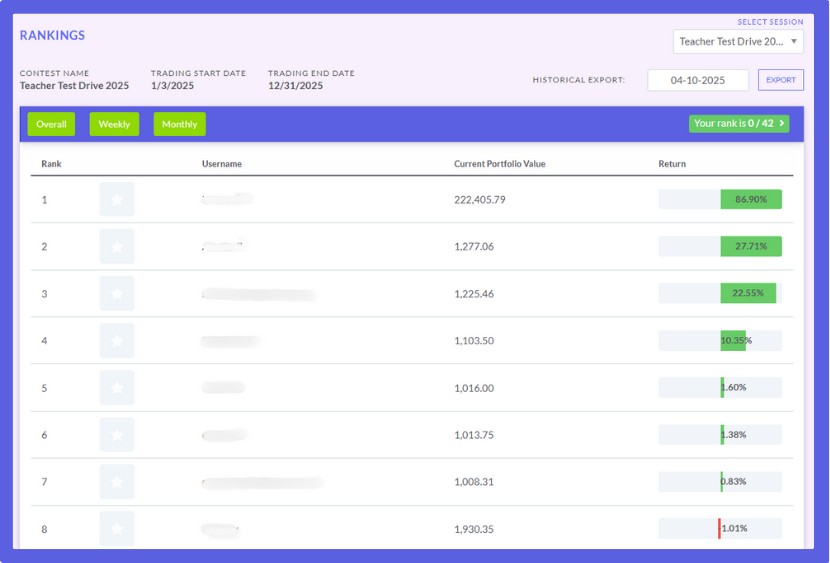

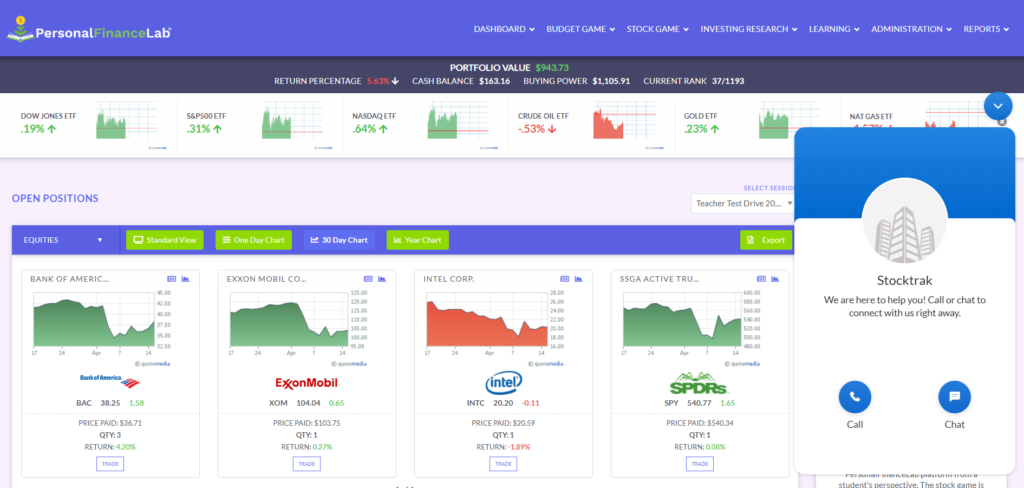

Portfolio Rankings & Engagement:

- SMG: Portfolio rankings typically update only once per day, usually at the end of the market day. In a world where students are used to instant feedback from apps and games, this delay significantly dampens engagement. The excitement of seeing their picks rise (or fall) during the trading day is lost.

- PFL: Features live, real-time rankings that update throughout the day. Students can see their position change dynamically as prices fluctuate. They can also filter rankings to see their overall performance, or just for the current week or month. This immediate feedback keeps today’s digital natives engaged inside and outside the classroom. Seeing their rank climb (or needing to figure out why it dropped) right now is far more motivating than waiting until tomorrow.

Integrated Research Tools

SMG: This is a major difference. The SMG platform itself has virtually no integrated research tools. Students must leave the simulation and use external websites (like Yahoo Finance, Google Finance, etc.) to research stocks, read news, or analyze company data. This presents several problems: students might get lost navigating external sites, encounter distracting ads, or even find that necessary financial sites are blocked by school internet filters.

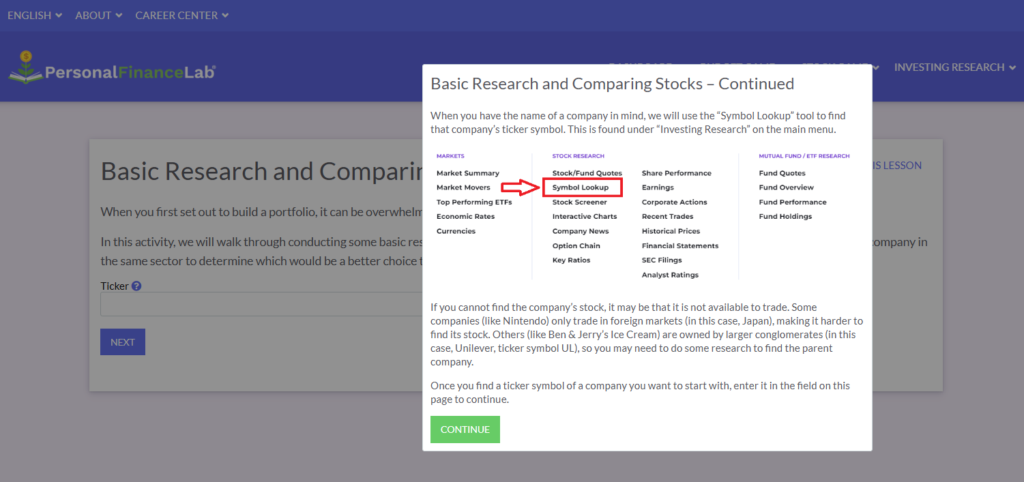

PFL: Integrates a comprehensive suite of research tools directly within the platform. Students never need to leave the site. This includes:

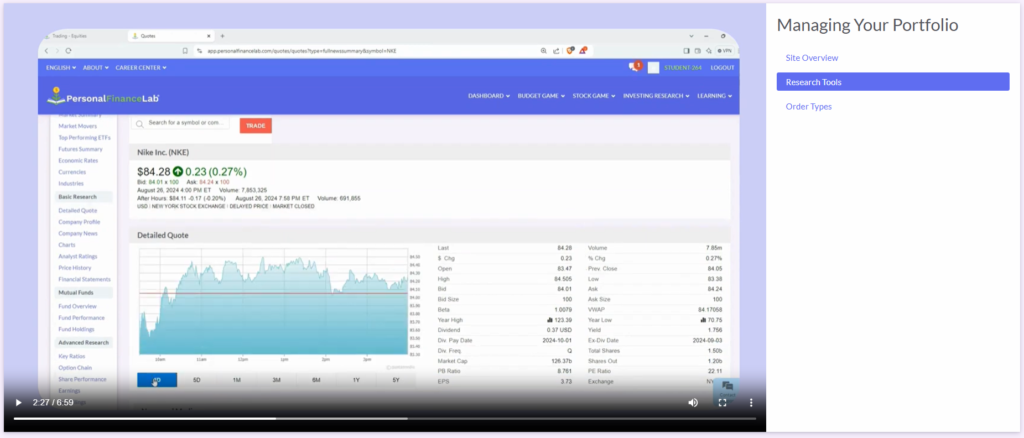

- Detailed Quote Pages: With interactive charts, key ratios, historical prices, analyst ratings, company news, earnings reports, and financial statements (from SEC filings). Similar data is available for ETFs and mutual funds.

- Stock Screener: Allows students to filter thousands of stocks based on criteria like market cap, P/E ratio, dividend yield, sector, etc., to find investments matching their strategy.

- Market Summary Pages: Give students a snapshot of the day’s market activity – top movers, sector performance, economic indicators, currency rates, futures summaries etc.

- “Explore” Tools: Sections dedicated to exploring stocks by sector (teaching them about the economy) or finding “Trading Ideas” to help them get started.

- Tutorials & Activities: Includes an interactive activity teaching students how to read a quote page, compare stocks within an industry, and use the research tools effectively. Video tutorials explain platform features.

This integrated approach keeps students focused, provides a safer browsing environment, and directly connects learning about research with the act of trading.

The Teacher Experience – Empowering Effective Instruction Through Flexibility

Let’s get real about what it takes to make these simulations work effectively in our classrooms. We know that “one size fits all” rarely works in education. Our students come in with different background knowledge, learn at different paces, and respond to different challenges. Our curriculum has specific goals and sequences. So, how does the platform support us in managing this dynamic environment and delivering targeted instruction?

SMG: Generally offers a standardized experience. The rules are set by the program or local coordinator. This means $100,000 starting cash, trading primarily US stocks/ETFs/funds/bonds, USD currency, and fixed trading dates for everyone in that session. There’s little to no room for teacher customization.

You’re essentially handed a fixed tool and have to adapt your teaching to it, rather than adapting the tool to your students and your teaching.

PFL: This is where PersonalFinanceLab offers immense power. Teachers have granular control over every aspect of the game:

- Trading Dates: Set your own specific start and end dates for registration and trading.

- Initial Cash: Choose anything from $1 to over $100 million. Want students to start small and feel the impact of every dollar? You can do that.

- Portfolio Currency: Choose from over 50 global currencies – perfect for teaching outside the US or adding an international context (CAD, EUR, GBP, JPY, AUD, etc.).

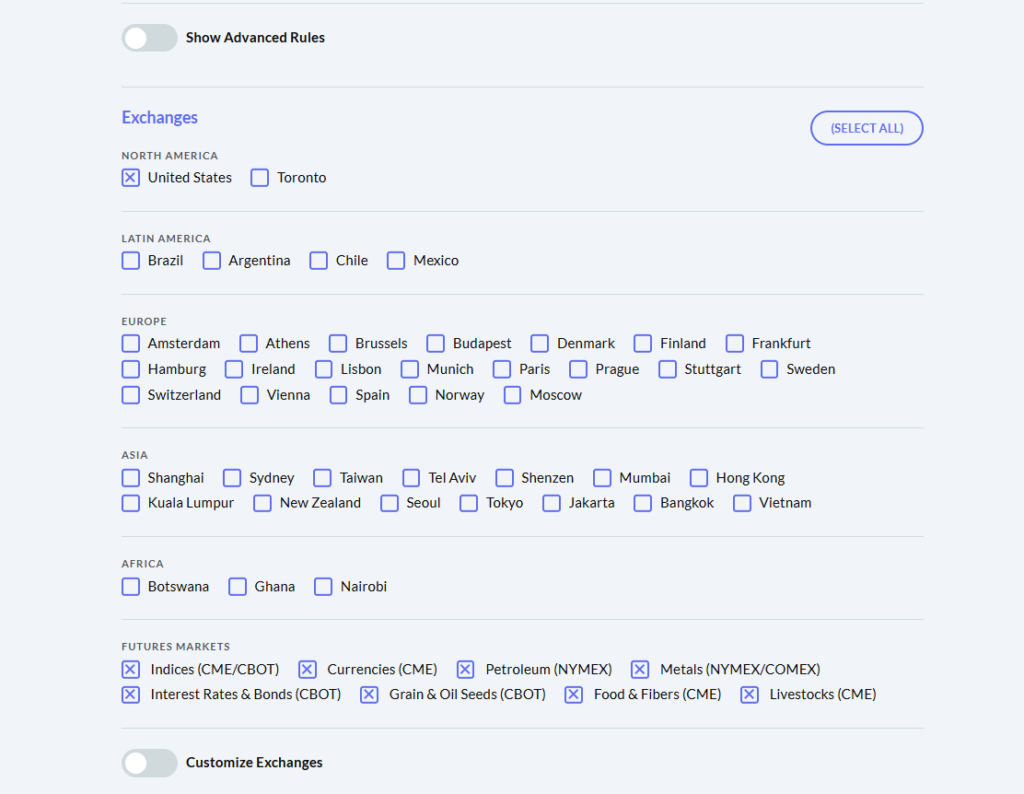

- Allowed Securities: Start simple (US stocks only)? Or introduce complexity gradually? You can enable/disable Stocks, ETFs, Mutual Funds, Bonds (Corporate & Treasury), Options, Futures, Crypto (100+ types), Forex, and more. You can even turn types on/off during the simulation.

- Trading Rules: Set commission rates (even different rates per security type!), interest earned on cash, interest charged on loans, enable/disable margin trading, short selling, day trading, set minimum stock prices for orders, require trade notes for justification.

- Exchanges: Limit trading to specific exchanges (NYSE, NASDAQ) or open it up globally (Toronto, London, Frankfurt, Tokyo, Sydney, dozens more across continents).

- Security Lists: Create whitelists (students can only trade specific tickers you choose) or blacklists (prevent trading in specific stocks, perhaps for ethical reasons or to avoid overly volatile penny stocks).

This level of customization means you can precisely align the simulation with your curriculum, scaffold the learning by introducing concepts gradually, differentiate for varying student abilities, and create a truly tailored experience.

Need to focus only on Canadian stocks with CAD currency? Easy. Want an advanced class trading options and futures? Done. SMG doesn’t offer this adaptability.

Getting Help – Support Structures

When questions arise (and they always do!), how easy is it to get answers?

- SMG: Support typically relies on contacting the local program coordinator or submitting tickets through the SIFMA Foundation’s channels. Response times can vary.

- PFL: Offers multiple layers of direct support:

- Live Chat: Available during market hours for both teachers and students. If a student hits a technical snag or has a platform question, they can get immediate help without interrupting the class or waiting for the teacher. Teachers can use it for quick questions about settings or features.

- Dedicated Account Managers: Teachers get a dedicated contact person for onboarding, training, setup assistance, and strategic advice on using the platform effectively.

This direct and multi-channel support structure generally means faster resolutions and less burden on the teacher.

The “Extras” – Beyond the Stock Market Simulation

While our focus has been the stock game itself, both platforms offer additional value:

- SMG’s Unique Offerings: SIFMA has a long history and provides national access to its unique and valuable competitions. InvestWrite (essay competition) and the Capitol Hill Challenge (connecting student teams with members of Congress) are well-established programs that offer networking opportunities and are compelling reasons some schools participate in SMG. They also provide teacher resources, though usually separate from the simulation interface.

- PFL’s Integrated Ecosystem: PFL’s “extras” are built around creating a more holistic financial education platform:

- Integrated Budget Game: A whole separate simulation teaching students how to manage a monthly budget, set and hit their monthly savings goals and how to use credit responsibly. Students can transfer money they’ve saved in their Budget Game savings account directly into their cash balance for the Stock Game. The Budget Game component, especially with that powerful savings-to-investment link, addresses critical life skills and connections that SMG simply doesn’t cover. It prepares them for life.

- Vast Curriculum Library: Over 300 self-grading lessons, videos, and activities covering personal finance, investing, economics, business, and career prep, assignable directly within the platform. You can create assignments where students read a lesson, watch a video, use a calculator, take a self-grading quiz, and then apply that knowledge directly in the Budget or Stock game. The connection is seamless and reinforces learning immediately.

- Robust Teacher Reporting: Detailed dashboards for teachers track individual student actions, quiz scores, time spent, trade history, budget decisions, and more. Custom report building is also available.

SIFMA Stock Market Game™ vs. PersonalFinanceLab®

Time to put them side-by-side! Let’s break down the key differences you need to know when selecting your classroom’s financial simulation tool.

| Feature | SIFMA Stock Market Game™ | PersonalFinanceLab® Stock Game | My Take |

| Customization (Game Rules) | Minimal / Standardized (Fixed cash, rules, limited securities) | Extensive / Granular (Control cash, rules, securities, exchanges, dates, etc.) | PFL wins decisively here. Tailor the game precisely to your curriculum & student needs; SMG is one-size-fits-all. |

| Integrated Research Tools | None / External Resources Required (Students must leave platform) | Extensive / Built-in (Quotes, charts, financials, news, screeners within platform) | Major PFL advantage. Keeps students focused & teaches research skills contextually; SMG adds friction & external site risks. |

| Portfolio Rankings Update | Daily / End-of-Day | Near Real-Time | PFL boosts engagement significantly. Live updates match student expectations; SMG’s delay feels outdated. |

| Trading Realism & Data | Basic (After-hours orders cancel; Manual fixes needed for splits/dividends) | More Robust (Pending orders hold; Advanced order types; Auto splits/dividends) | PFL offers a smoother, more accurate simulation. Less frustration with order handling and data integrity. |

| Available Securities & Markets | Limited (Primarily US Stocks, Bonds, Funds, ETFs) | Broad (Incl. Options, Futures, Crypto, Forex, 50+ Global Exchanges) | PFL provides far greater depth and global exposure possibilities, adaptable to lesson scope. |

| Direct User Support | Via Coordinator / Support Tickets | Live Chat (Students & Teachers) + Dedicated Account Managers | PFL offers more immediate and accessible help for both students and teachers during market hours. |

| Primary Learning Mode | Team-Based | Individual Accounts Standard (Team option available) | Choose based on goals: SMG mandates teams; PFL defaults to individual tracking but offers team play. |

| Cost & Access | Often Free/Low-Cost (Sponsor-dependent); Adult registration needed <18 | Paid Platform (Starting at $10/student account); Direct student access | SMG’s cost is appealing, but PFL’s simulation features reflect the investment in flexibility and depth. |

PersonalFinanceLab® operates on a per-student license model, starting at $10 per student. Now, I know budgets are always a key consideration for us educators. The good news is that significant bulk discounts are available for larger classes, schools, or entire districts. The larger the group, the lower the per-student cost typically becomes.

If you’re at a Title 1 school or serving students in low-income areas, definitely reach out. PFL works actively with sponsors across the country who are often able to cover the full cost of access for qualifying schools. Don’t assume it’s out of reach!

Click here to request more info and get a personalized quote.

The Bottom Line

The Stock Market Game™ has a long history and provides access to its unique and valuable InvestWrite and Capitol Hill Challenge competitions. If those specific programs are your main goal, or if a free/very low-cost option is the absolute deciding factor, SMG is a valid choice.

However, if you are looking for the most powerful, flexible, realistic, and engaging stock market simulation platform for your classroom, PersonalFinanceLab® clearly comes out ahead.

PFL directly addresses many of the common frustrations teachers and students encounter with the SMG simulation:

- Its trading mechanics are more realistic with pending orders and advanced order types.

- Its data is more reliable with real-time market data and automatic handling of splits/dividends.

- Its live rankings dramatically boost student engagement.

- Its integrated research tools provide a seamless and essential learning experience unavailable in SMG.

- Its unmatched customization options allow teachers to tailor the game perfectly to their students and curriculum.

- Its direct live chat and dedicated support offer better assistance.

While SMG introduces investing, PFL provides a deeper, more robust simulation environment designed for modern learners and educators who need flexibility. For most classrooms focused on delivering the best possible learning experience through a stock game, PersonalFinanceLab® is simply the better-equipped tool for the job.

Ready to see the difference first-hand?

Click Here to Explore PersonalFinanceLab

Visit the Official Stock Market Game Website

Making the right choice empowers your students with practical skills and hopefully sparks a lifelong interest in managing their financial future. Keep sparking those “aha!” moments!