Bringing financial literacy to life in the classroom demands more than presenting information; it requires engagement, practice, and the chance for students to grapple with realistic financial decisions. Both Everfi® and PersonalFinanceLab® are prominent platforms aiming to equip students with essential money skills, but they employ distinct philosophies and tools. Everfi offers broad access to module-based introductions across many topics, often free to schools. PersonalFinanceLab provides an immersive, simulation-centric platform designed for sustained skill development for financial decision-making.

I’ve used and seen a lot of tools over the years, and I wanted to share my perspective on how these two stack up when you’re looking for a complete solution to bring financial literacy alive for your students.

Core Philosophy: Quick Modules vs. Long-Term Practice

Everfi is fantastic at providing a wide range of digital lessons on all sorts of real-world topics – financial literacy, health, careers, you name it. They work with sponsors, which means schools usually get access completely free. That’s a huge plus right off the bat! Each lesson is like a self-contained unit, often interactive and game-like, designed to introduce specific concepts clearly and efficiently. They’ve even earned recognition like the ISTE Seal, so the quality is definitely there. It’s a great way to cover a lot of ground quickly.

Here is an overview of their modules for Financial Education for High School Students:

- Tax Simulation: Understanding Taxes

- Financial Literacy for High School Students

- Marketplaces: Investing Basics

- Accounting Careers: Limitless Opportunities

- Data Science Foundations and Exploration Lab

- Minding Your Money: Skills for Life

- Econ Foundations: Economics for High School

- Built: Credit Fundamentals

- Modern Money: Safe Digital Banking

- EVERFI Pathways: Financing Higher Education

- Crypto Foundations

- Grow: Financial Planning for Life

- Venture: Entrepreneurial Expedition

- Health Literacy Curriculum for High School

PersonalFinanceLab, on the other hand, approaches financial education with immersive, real-world simulations. The idea here is that students learn financial habits by doing them repeatedly. PFL focuses on its Budget Game and Stock Game as the main ways students get exposure to different financial situations and then wraps a whole curriculum around that experience to connect the dots. It’s less about just introducing a topic and more about letting students live it virtually.

The Student Experience: What Budgeting Practice Looks Like

This is where you really see the difference in the classroom.

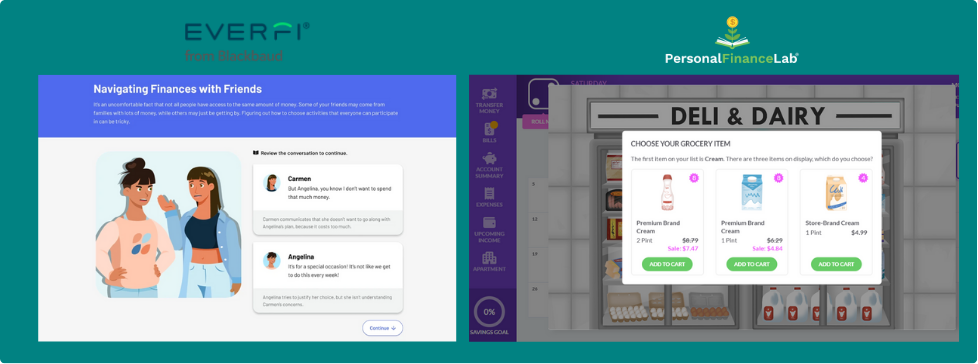

With Everfi, students learning about budgeting will typically work through scenarios within a module. Maybe they’ll help a character make spending choices or use a tool to categorize expenses. It’s effective for explaining concepts like needs vs. wants or tracking spending within that specific lesson. They learn the concept, do a quick activity, and take a quiz.

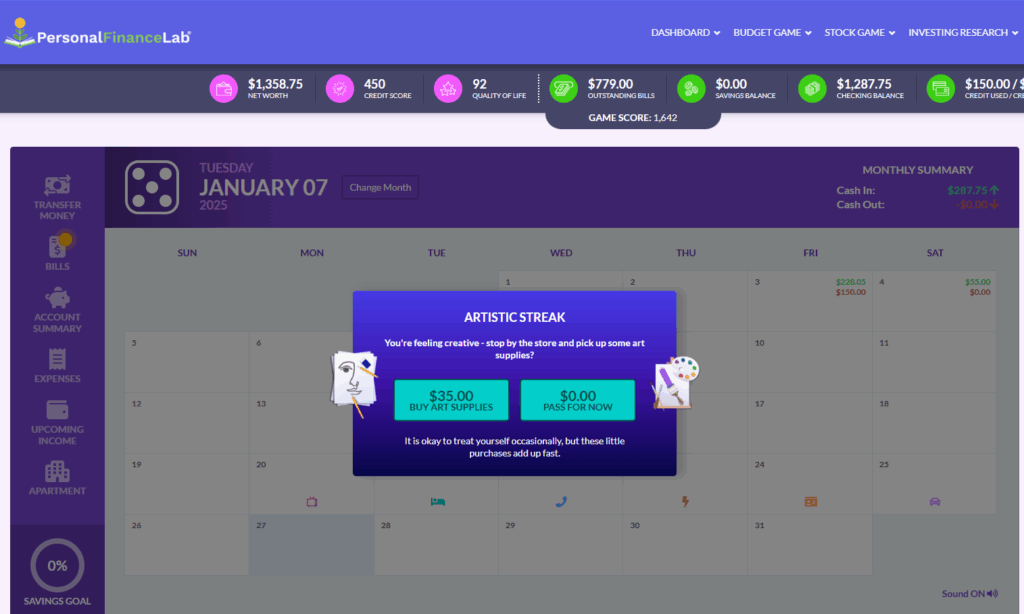

When students use PersonalFinanceLab’s Budget Game, it’s a completely different experience. They’re dropped into a simulation that runs for a full virtual year (we usually break it down over several class periods, maybe 20-30 minutes per “month”). They get a part-time job, have actual bills to pay (rent, insurance – teachers can adjust these settings to match their local reality).

Students make dozens of decisions that have consequences on the experiences they encounter in the Budget Game. From whether or not to invest in art supplies, attending a concert with their friends, whether they should work extra hours or spend their weekend on household chores, and many other financial decisions that replicate what it’s like to manage a monthly budget.

They must balance unexpected expenses with setting and reaching their monthly savings goals. They’re put in the driver’s seat having to balance paying for their bills and expenses with their credit and debit cards. This level of practice does not exist on Everfi where the modules introduce different scenarios with an either/or choice. They don’t get to simulate what it will really feel like to have their credit score go down after missing a payment, or what happens if they don’t have an emergency savings fund when a large bill pops up.

PFL feels much more personal, and you see those lightbulbs go off about how their choices have consequences and why planning for the future is so important. From the Budget Summary page, students can track key metrics like Net Worth, Credit Score, and Quality of Life, and see the direct impact of their budgeting, saving, and spending decisions illustrated in the trend graph. This helps them understand the long-term consequences of their choices, analyze their habits, and identify areas for improvement to succeed in the simulation and build better financial skills.

All the transactions they make with their debit and credit card, as well as all contributions to their savings account can be accessed just like in a real bank account from the statement pages. Replicating how real bank accounts work and preparing students for life after graduation.

The Student Experience: Getting Hands-On with Investing

The same difference applies to investing.

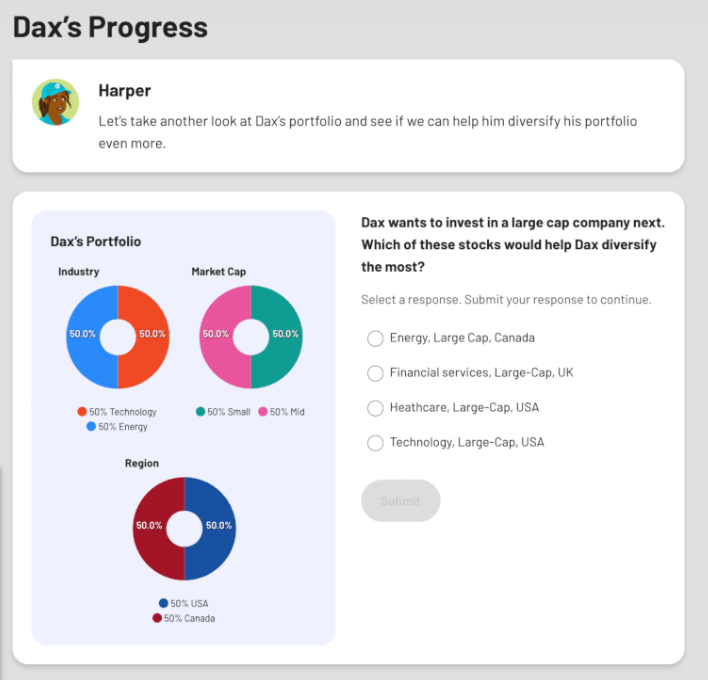

Everfi modules like “Marketplaces: Investing Basics” do a solid job introducing the concepts – stocks, bonds, risk vs reward, and diversification. They use clear explanations with some interactive charts, and often include a short, self-contained simulation where students invest some virtual money in fictional companies to see how it works. It’s a good introduction to the vocabulary and basic ideas.

However, the practice provided within Everfi often remains at an abstract level. As illustrated in the screenshot showing “Dax’s Progress,” students are presented with a fictional character’s portfolio and asked to make a hypothetical decision for them. While this teaches students to apply concepts like diversification (as seen in the pie charts and the multiple-choice question asking which stock would help “Dax” diversify), it’s a one-off, quiz-like interaction about someone else’s money.

There’s no personal connection to their own virtual funds, no ongoing management of their portfolio, and no link to actual, real-time market performance. This level of abstraction takes away the impactful feeling of making a decision with your own money and seeing its outcome in the live market.

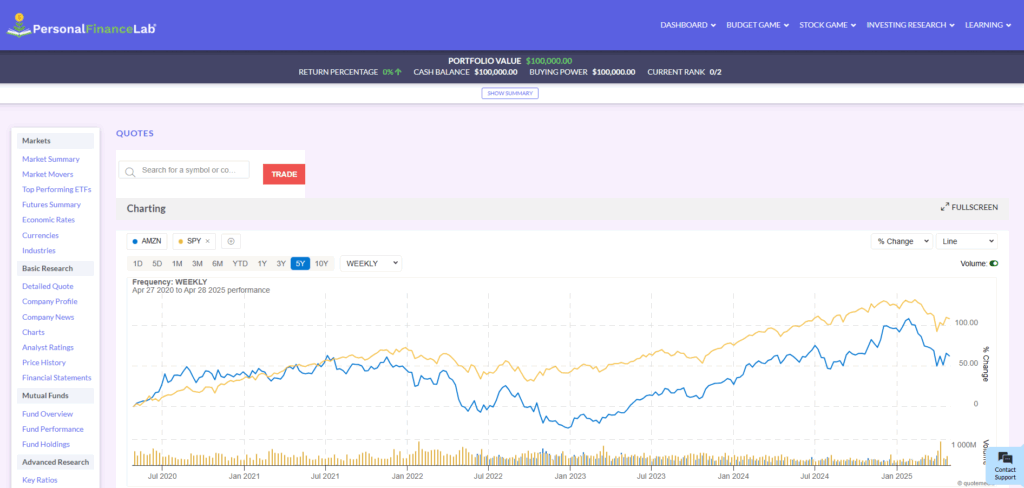

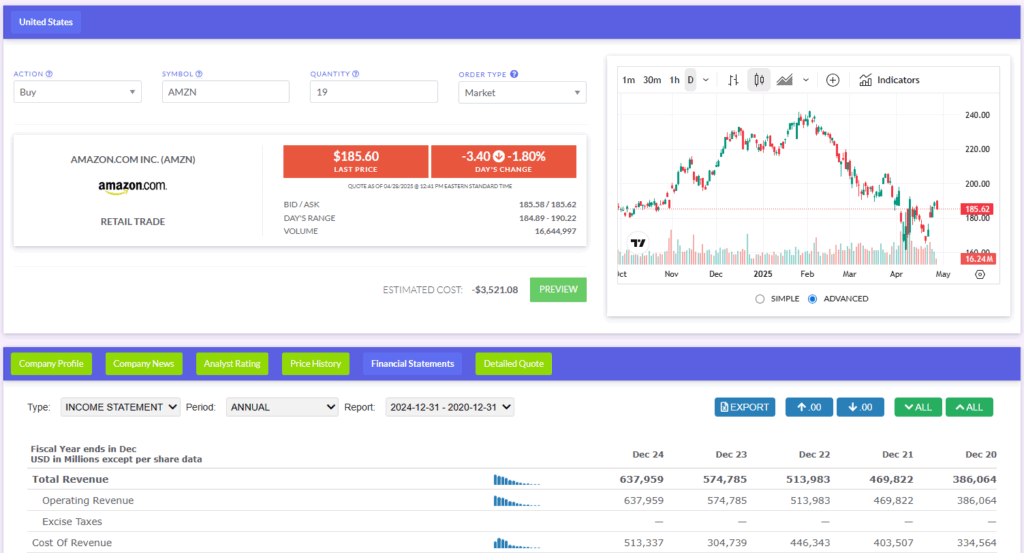

With PersonalFinanceLab’s Stock Game, students are managing their own virtual portfolio, often for several weeks or even a whole semester, depending on long you set-up your session. They’re trading real companies (or funds, bonds, even crypto if you want to enable it) using real-time market data on exchanges from the US and around the world. The key here is the integrated research tools. They aren’t just told about P/E ratios or reading charts; they have tools right there – like on a real brokerage site – to look up company financials, news, screen for stocks based on criteria we discuss in class, and then make their trades. Seeing those live rankings update during the day gets them checking their portfolios and asking why things are moving – it sparks genuine curiosity and teaches analysis skills in a way a quick module just can’t replicate.

Curriculum & Content Delivery

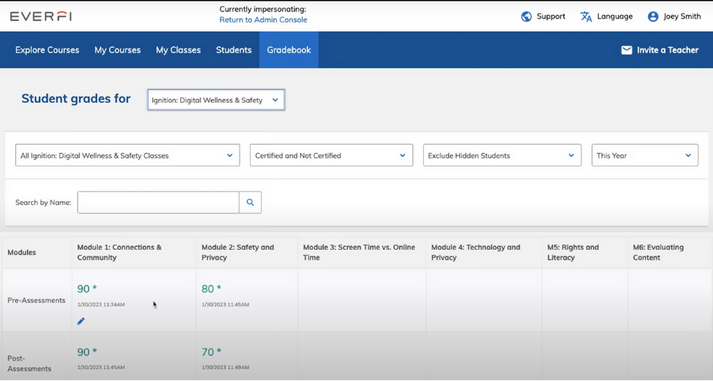

Everfi shines with its sheer breadth of content. They have modules covering just about every key financial topic you need to teach: Banking, Credit, Taxes, Paying for College, Investing Basics, Digital Safety, and more. Each module is standards-aligned and ready to go, with those handy pre- and post-assessments to assess how well students are retaining key concepts. It’s incredibly useful for ensuring you’ve covered specific standards, or if you need a solid digital lesson on a particular topic. They also include offline resources, which is a nice touch for blending the learning.

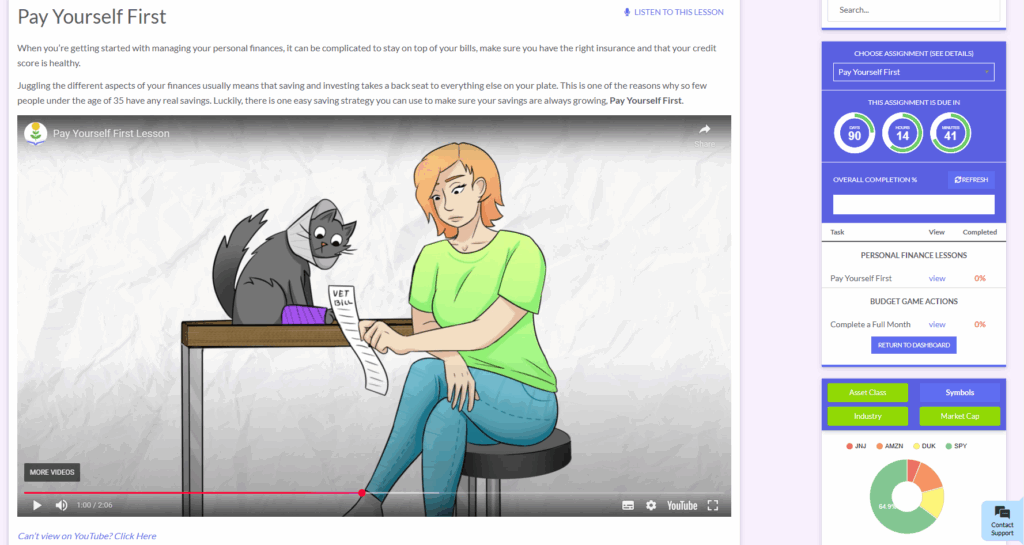

PersonalFinanceLab also has a huge library – over 300 self-grading lessons, videos, and activities covering personal finance, investing, economics, business, etc., aligned to both national and state standards. What I find particularly powerful as a teacher is how tightly integrated it all is with the simulations. I can assign a lesson on diversification right before students start building their stock portfolios, or have them watch a video on the Pay Yourself First savings strategy, and require them to complete a month in the Budget Game as part of their assignment.

Teachers can even set it up so completing assignments earns students a little extra virtual cash in the games! Plus, students can transfer their savings from the Budget Game into their investment account in the Stock Game, connecting the dots between saving and investing beautifully.

PersonalFinanceLab also has pre/post tests that can be assigned at the beginning and end of your session to gauge how well the lessons and games worked together to teach your students about core financial literacy concepts, (instead of per module like on Everfi).

The Teacher Experience: Easy Deployment vs. Fine-Tuned Control

Everfi is known for being turnkey and user-friendly. Teachers appreciate that they can quickly find a relevant module, assign it, and rely on the automated grading and reporting. It saves a ton of prep time, especially when introducing topics that might be outside your core expertise. The free access and comprehensive support, including training and even local specialists, make it very easy to get started and implement.

Other than hiding/unhiding the available courses from the student view, there is no customization available on any of the Everfi modules.

PersonalFinanceLab emphasizes deep teacher customization and control, particularly within its simulations, allowing educators to tailor the experience for their particular situation. Below is a breakdown of all the settings that be customized per class/session:

Class Creation & General Settings

- Challenge Name: Customize the name of the class session.

- Description: Provide a detailed description for the class.

- Registration Start/End Dates: Set the timeframe during which students can register.

- Session Password: For private contests, set a password required for student registration.

- Time Zone: Set the time zone for the session.

- Include Budget Game or Stock Game: Toggle the Budget Game simulation on or off.

- Choose Your Set-Up: Select between Express (default settings) or Custom setup to unlock detailed options.

- Your Contest Is (Public/Private): Choose if the registration link is open or requires a password.

- Enable Forum: Toggle the student forum discussion feature on or off.

- Display Badges: Toggle whether earned badges are displayed to students.

- Display Certifications: Toggle whether students can earn Investing101 or Financial Literacy certificates upon completion of required assignments.

- Pre/Post Test Required: Toggle whether students must take a basic financial literacy test at the start and end of the session.

Stock Game Settings

- Trading Dates: Set the specific timeframe during which trading is allowed.

- Currency of Portfolio: Choose the base currency for student portfolios.

- Weekly Deposits: Toggle weekly cash additions to student portfolios on or off, and set the custom amount.

- Initial Cash Balance: Set the starting cash amount for student portfolios.

- Minimum Stock Price for Buying: Set a minimum price threshold for buying stocks.

- Minimum Price For Shorting: Set a minimum price threshold for short selling.

- Interest Earned on Cash %: Set the interest rate earned on uninvested cash (can be positive or negative).

- Interest Charged on Loan %: Set the interest rate applied to margin loans.

- Allow Buying on Margin: Toggle margin trading on or off.

- Allow Short Selling: Toggle short selling on or off.

- Allow Day Trading: Toggle same-day buy/sell trading on or off.

- Allowed Trades per Account: Set a maximum total number of trades allowed per student for the session.

- Limit Number of Trades per Day: Toggle whether there is a limit on trades per day (setting the specific number is implied but not detailed in the PDF).

- Make All Portfolios Public: Toggle whether students can view each other’s portfolios and holdings.

- Require Trading Notes: Toggle whether students must provide notes justifying their trades.

- Your Admin Account to Appear in Rankings: Toggle whether the teacher’s account is included in class rankings.

- Display Sharpe Ratio Rankings: Toggle the display of rankings based on Sharpe Ratio.

- Display Alpha Rankings: Toggle the display of rankings based on Alpha.

- Display Treynor Rankings: Toggle the display of rankings based on Treynor.

- Security Types: Select which types of securities students can trade (Equities, ETFs, Cryptocurrencies, Options, Mutual Funds, Bonds, Futures, Future Options, Forex, Cash Spots).

- Commissions: Set custom commission rates and methods (per trade, per share, percentage) for each security type.

- Exchanges: Select which international markets are open for trading.

- Customize Exchanges: Toggle on/off the use of customized exchange lists.

- White Listed Stocks: Specify a list of allowed ticker symbols students can trade on selected exchanges (cannot be used with Blacklist).

- Black Listed Stocks: Specify a list of disallowed ticker symbols students cannot trade (cannot be used with Whitelist).

- Advanced Rules Toggle: Enable access to more detailed settings.

- Position Limit: Set a maximum percentage of a portfolio that can be invested in a single company/ticker symbol.

- Diversification Limit: Set a maximum percentage of a portfolio that can be invested in a single asset class.

Budget Game Settings

- Budget Game Start/End Dates: Set the specific timeframe during which the Budget Game is active.

- Total “Months” the Game Is Played: Customize the duration of the simulation in virtual months.

- Speed Limit: Limit how many virtual months students can complete per real-life week.

- Participants Start the Game As: Choose the starting career path (College Student/Part-time or Full-time Worker) or allow students to start as students and graduate after a set number of months.

- Starting Account Balances: Set the initial cash amount in students’ checking and savings accounts.

- Hourly Wage ($/hr): Set the hourly rates for part-time and full-time jobs.

- Income Tax Rate (As a %): Adjust the income tax percentage (can be set by region/state/province).

- Recurring Monthly Bills & Expenses: Set the average cost for various monthly expenses:

- Monthly Rent (Students choose from options around this average)

- Phone & TV/Internet Bills (Students choose from options around this average)

- Grocery Bill (Students choose from options around this average)

- Car Payment / Insurance (Fixed amount)

- Gas Expense (Average amount, with slight random variation)

- Student Loan Payment: Set the amount (can be set to zero).

- Health Insurance: Set the amount (can be set to zero).

- Life Event Emphasis: Select specific categories of unexpected ‘Life Events’ to emphasize during the game.

- Include Apartment Feature: Toggle the My Apartment visual feature on or off.

Assignment Settings

- Assignment Name: Customize the name of each individual assignment.

- Start/End Dates: Set specific start and end dates/times for each assignment.

- Prerequisite: Set a previous assignment that must be completed before this one becomes available.

- Reward: Set a custom cash amount to be deposited into the student’s Budget Game checking or Stock Game buying power upon completing the assignment.

- Minimum Grade: Set a minimum score students must achieve on assessments within the assignment to receive credit/reward.

- Select Specific Lessons/Tasks: Choose individual Lessons, Tutorial Videos, Activities, or Actions from the entire Learning Library to include in an assignment.

- Allow Retries for Quizzes: Toggle for each lesson whether students can retake the associated pop quiz multiple times.

- Use Suggested Assignments Tool: Automatically select lessons based on chosen State Standards, Subject, and Unit as a starting point for an assignment.

- Integrate Budget Game Actions: Include specific Budget Game tasks (like completing a month) as requirements within an assignment, potentially triggering a Stock Game reward.

- Copy An Older Assignment: Reuse the content selection from a previously created assignment as a template for a new one.

Other Teacher Customizations

- Manage Market Insight Widgets: Customize the content displayed on classroom projection screens (e.g., class rankings, news, watch-lists, “Words of the Day”).

- Send Announcements: Post custom text/image/link announcements that appear on every page for students.

- Send Messages: Send custom messages to the entire class through the messaging center.

- Custom Reporting Tools: Build and export custom reports by selecting desired data categories (User Info, Stock Game Stats, Budget Game Stats).

- Manage Teams: Create, name, and manage teams for students participating in the Stock Game.

Support & Cost

Everfi provides excellent support as part of its free package, which is a major advantage. You get access to training, resources, and often personalized help.

PersonalFinanceLab also has strong support, including that handy live chat (available during business hours or through tickets submitted outside those hours) and dedicated account managers for teachers who really help you get the most out of the platform. It is a paid platform, but the cost reflects the depth of the simulations and customization. Significant volume discounts are available, and crucially, they actively work to get sponsorships for Title 1 and low-income schools, so don’t assume the cost is a barrier without asking. And for those of us with smaller classes or home school settings, TeachPersonalFinance.com offers access.

PersonalFinanceLab® vs Everfi®

Building on the detailed comparison above, the following table provides a side-by-side look at key features offered by PersonalFinanceLab and Everfi. This overview highlights the core functionalities, content breadth, student and teacher experiences, to help educators quickly compare the platforms and determine which best aligns with their teaching approach and classroom requirements.

| Feature | Everfi® | PersonalFinanceLab® | My Take |

| Core Approach | Module-based learning; introduces broad concepts | Simulation-centric; builds skills through sustained practice | Everfi introduces topics quickly via modules; PFL builds practical skills through repeated, immersive simulation practice. |

| Primary Funding | Free (Sponsor-funded) | Paid. Starting at $10 per Student Account (Volume Discounts Available) | Everfi is often free due to sponsorships; PFL is a paid platform offering deeper features with potential sponsorship for eligible schools. |

| Budgeting Simulation | Scenario-based within modules; illustrative; short-term | Realistic, long-term sim (12-mo); manages own accounts/credit | PFL’s decision-driven sim offers realistic consequences and personal connection, unlike Everfi’s module scenarios. |

| Investing Simulation | Basic simulations within modules; conceptual; fictional assets | Dynamic, long-term portfolio; real data; global markets | PFL’s real-time, integrated-tool stock game allows practice with actual market data and analysis skills over time, beyond Everfi’s intros. |

| Student Agency | Follows pre-set paths & scenarios | Manages own virtual finances; makes independent decisions | PFL gives students direct control and decision-making power over their virtual finances, fostering greater ownership. |

| Data Realism (Investing Sim) | Simplified, illustrative data | Real-time market data; live rankings | PFL uses real-time market data for dynamic, authentic practice, while Everfi uses simplified illustrative data. |

| Research Tools (Investing Sim) | Limited or relies on external resources | Extensive, integrated tools (quotes, charts, financials, screener) | PFL integrates extensive research tools directly into the platform, making real-world analysis more accessible than Everfi. |

| Curriculum Scope | Broad (Fin Lit, Careers, Health, SEL, etc.); Modular | Deep (Fin Lit, Invest, Econ, Biz); Integrated with Sims | Everfi offers broad coverage across many topics; PFL provides deep content, particularly integrated with simulations. |

| Teacher Customization | Select & assign modules; Hide/Unhide content | Extensive control over simulation rules, settings, securities | PFL offers extensive, granular customization for games and assignments, providing fine-tuned control absent in Everfi’s fixed modules. |

| Reporting | Personalized local support, PD, training | Live chat (all users); Dedicated Account Managers | Both platforms offer comprehensive teacher support, including training and direct assistance. |

My Takeaway: Introduction vs. Transformation

Look, Everfi is a fantastic resource. It provides high-quality, engaging introductions to so many important topics, and the fact that it’s free makes it incredibly accessible. If you need to cover specific standards quickly or introduce foundational concepts efficiently, it’s a go-to tool for many teachers, and for good reason.

But, if your goal is to really push students beyond just knowing the terms – if you want them to develop the habits and confidence that come from actually doing personal finance – then PersonalFinanceLab offers a depth of experience that’s hard to beat. The focus on realistic, long-term simulations where students are in charge of their own virtual money just clicks differently.

It really comes down to your goals. For broad introductions across many topics with maximum ease and zero cost, Everfi is excellent. For deep, practical skill-building through immersive simulation and customized learning, PersonalFinanceLab provides the tools to make that happen.

Hope this perspective helps as you choose the right fit for your students!

Ready to see how immersive simulations can transform your finance lessons?