Personal Finance Lab

Why PersonalFinanceLab is My Go-To for Engaging Students

Hey fellow educators,

We all know how crucial financial literacy is. We’re not just teaching subjects; we’re equipping our students with skills they’ll use for the rest of their lives. But let’s be honest – finding ways to make concepts like budgeting, investing, and credit management truly stick can be a challenge. Textbooks and lectures have their place, but getting students genuinely engaged and providing them with safe, practical experience? That’s the holy grail.

For years, I’ve explored different tools and resources, and I keep coming back to one platform that consistently delivers results and gets students genuinely excited: PersonalFinanceLab. As an authorized reseller through TeachPersonalFinance.com, I want to share why I’m so enthusiastic about it and how it can transform your classroom, whether you’re teaching a small group or homeschooling.

Boost Student Engagement in Financial Literacy with PersonalFinanceLab

The biggest hurdle we often face is student engagement, especially with complex financial topics. PersonalFinanceLab tackles this head-on. It’s not just another educational software; it’s an immersive experience.

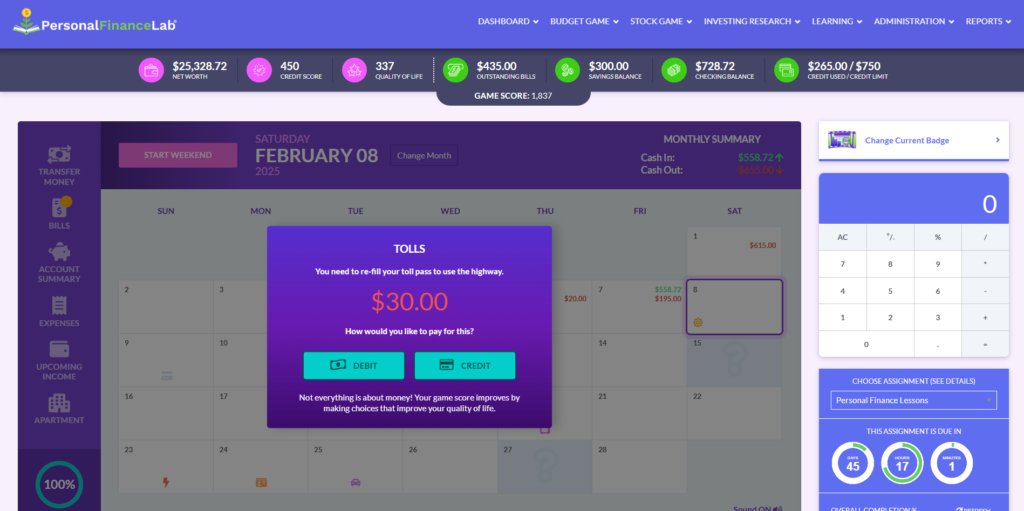

It’s one thing to talk about budgeting or investing; it’s another for students to actually experience the consequences of their choices. PersonalFinanceLab excels at creating this experience. Students aren’t just reading definitions; they’re actively managing virtual money, facing unexpected expenses, and seeing how their decisions play out month by month in the Budget Game, or day by day in the Stock Game.

This hands-on approach demystifies complex topics and fosters genuine understanding in a way lectures often can’t. And the impact is measurable: an overwhelming 98% of students feel more prepared for managing their finances after using PersonalFinanceLab. That’s the power we’re talking about – turning abstract concepts into tangible experiences that build real confidence and understanding.

So, What Exactly Is PersonalFinanceLab?

At its core, PersonalFinanceLab is a fully gamified platform combining two powerful simulations with a comprehensive curriculum library:

The Budget Game

This isn’t just about tracking expenses. Students step into a simulated life – earning income (as a student with a part-time job or a full-time worker, you can even customize this!), paying realistic monthly bills (rent, utilities, insurance), managing checking and savings accounts, and navigating credit cards.

They learn the vital habit of “Pay Yourself First” and the real consequences of credit card debt, all in a risk-free environment. It’s incredibly intuitive, and honestly, fun! I’ve seen students get so into it, they play outside of class time.

Then come the ‘Life Events’ – the game’s curveballs! These unexpected financial situations force students off autopilot, compelling them to make critical decisions where they instantly see the results reflected in their savings, credit score, and Quality of Life.

The Stock Game

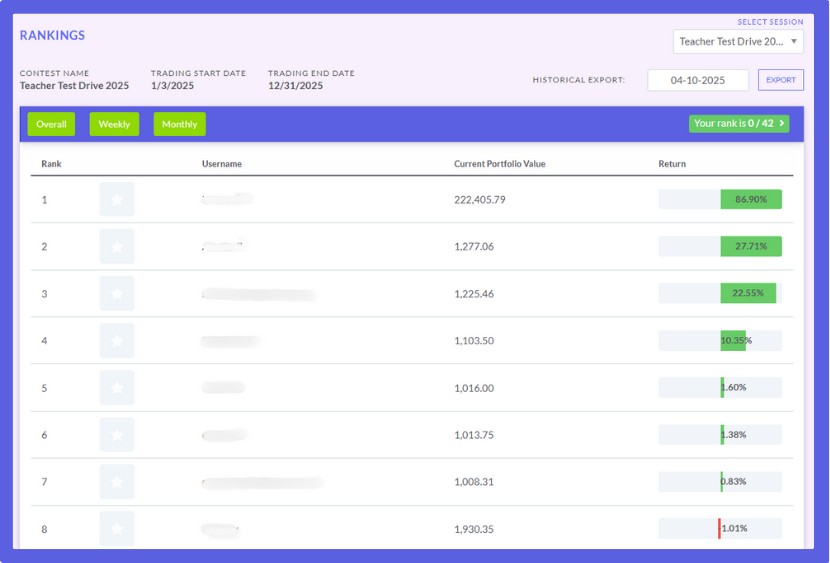

Forget static examples. This simulation plunges students into the world of investing with virtual money but real-world conditions. They can trade stocks (with real-time US prices!), bonds, mutual funds, and even explore global exchanges and cryptocurrencies (depending on the settings you choose – more on that later!). What I love is that the research tools – quotes, charts, company fundamentals, news – are built right in. Students learn the mechanics of trading, the importance of diversification (sometimes the hard way!), and how market events affect their portfolio.

The live class ranking inject a healthy dose of competition and is consistently one of the most popular aspects of the platform for students. They’re not just checking their own progress; they’re seeing how they stack up. Students start asking why – why did certain stocks move, why is their portfolio down, what are others doing differently? This curiosity provides fantastic, organic opportunities for deeper learning about market forces and investing principles.

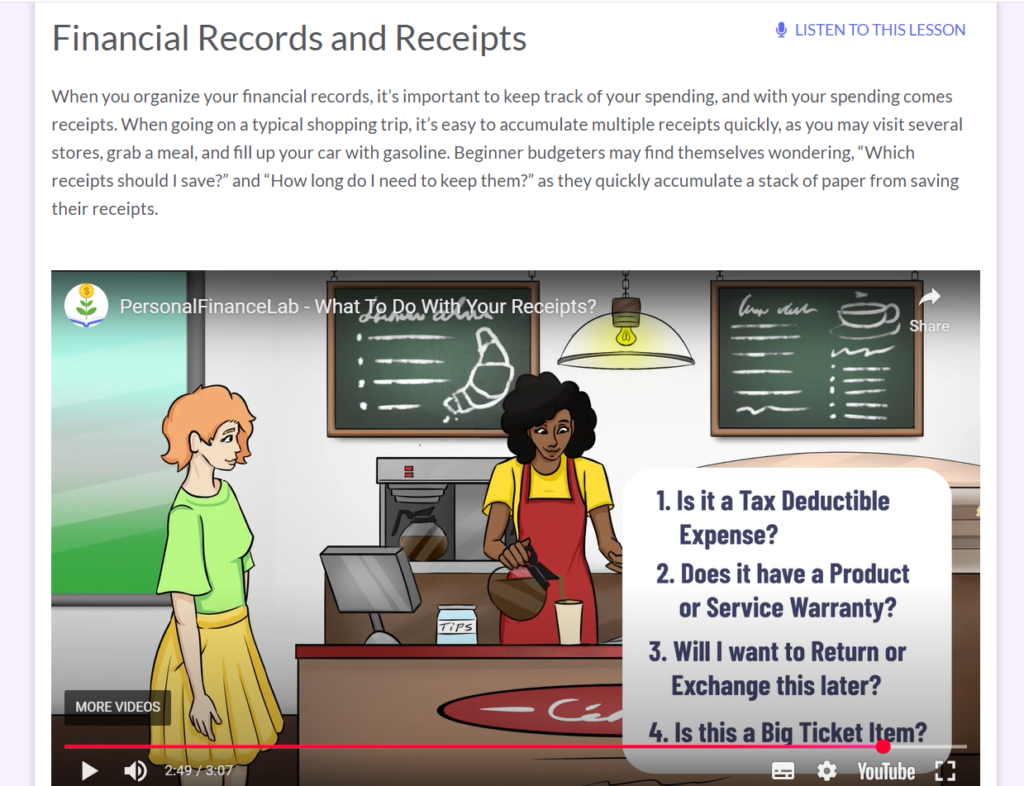

Standards-Aligned Curriculum

Backing up the games is a library of over 300 lessons covering personal finance, investing, economics, business, career prep, and more. These aren’t dry readings; they include videos (like the animated series explaining concepts like Compound Interest or What to Do with Your Receipts), interactive calculators, and self-grading quizzes. Everything is aligned to national (Jump$tart, CEE, NBEA) and state standards, making it easy to integrate and track mastery.

Click here to learn more about the financial literacy resources available on PersonalFinanceLab.

Why I Love It (And Why You Will Too)

From an educator’s perspective, PersonalFinanceLab is a lifesaver:

- Instant Engagement: I can get students up and running the same day. The built-in tutorials mean less hand-holding and more immediate “doing.” Seeing them check rankings between classes or discuss stock picks tells me they’re genuinely invested (pun intended!).

- Deep Learning Through Connection: Students see how saving in the Budget Game can fund their investments in the Stock Game. It connects the dots between responsible money management and wealth building.

- Powerful Teacher Tools: The admin dashboard is fantastic. You can easily monitor student progress in both games, see their trades and budget decisions, and even identify areas where the whole class might be struggling based on quiz results. It makes targeted feedback and intervention simple.

- Flexibility: I love that I’m not locked into a one-size-fits-all approach. The platform lets me start students with the fundamentals and then activate more advanced features – like different investment types or exchanges – step-by-step as their knowledge grows. This ensures the experience remains relevant and appropriately challenging throughout the course.

- It Saves Time: With ready-made lessons, activities, and automatic grading/tracking, it frees you up to focus on teaching and facilitating those crucial discussions sparked by the simulations.

Making it Accessible: The TeachPersonalFinance.com Offer

PersonalFinanceLab often works with schools for larger site licenses (20+ students), which include deep customization and LMS integration. However, I know many homeschool parents and teachers with smaller classes need access too.

That’s where TeachPersonalFinance.com comes in. As an authorized reseller, we offer a specific Small Classes and Homeschool version that includes:

- Access to both the Budget Game and the Stock Game.

- Access to the full Curriculum Library (300+ lessons, videos, etc.).

- Default game settings are turned on, providing a robust, ready-to-go experience.

- Game access for 6 months, Curriculum access for 1 year.

- Eligibility for students to earn Financial Literacy and Investing101 certificates.

- Access to live tech support during business hours.

This package is designed to give you the core power of PersonalFinanceLab without needing the minimum student numbers required for a direct site license. (If you do have 20+ students and need full customization or LMS integration, you can follow the link on our purchase page to connect directly with PersonalFinanceLab).

Getting Started is Easy

Worried about a steep learning curve? Don’t be. Students generally find the platform intuitive, thanks to the tutorials and live chat technical support. For teachers, PersonalFinanceLab even offers a free Teacher Test Drive so you can explore it yourself before committing. And as mentioned, excellent support is available.

Ready to Transform Your Financial Literacy Teaching?

If you’re looking for a dynamic, engaging, and effective way to teach financial literacy that goes beyond the textbook and truly prepares students for their financial futures, I wholeheartedly recommend PersonalFinanceLab. It fosters critical thinking, builds practical skills, and dare I say, makes learning about money management genuinely enjoyable.

Want to see how it can work for your students?

Click Here to Learn More About the PersonalFinanceLab

Let’s empower the next generation with the financial confidence they deserve!